I am only 28 but I am already thinking about retirement. Why?? Because I want to retire comfortably, I want to be able to travel and take my kids and grandkids on cruises. In order to do this, I need to have a plan. A big part of my plan is taking advantage of Roth Investments, allowing me to take out my money tax-free. If I invest 1 million dollars over my lifetime and it grows to 3 million dollars, it means I get to keep every cent of the 3 million dollars. I don’t have to pay anything to taxes.

I am only 28 but I am already thinking about retirement. Why?? Because I want to retire comfortably, I want to be able to travel and take my kids and grandkids on cruises. In order to do this, I need to have a plan. A big part of my plan is taking advantage of Roth Investments, allowing me to take out my money tax-free. If I invest 1 million dollars over my lifetime and it grows to 3 million dollars, it means I get to keep every cent of the 3 million dollars. I don’t have to pay anything to taxes.

Most people can contribute to a Roth-IRA. There are some exclusions like if you make too much money. You can contribute up to $5,500 dollars per year. When you hit 60 years old and retire you get to withdraw the money tax-free.

Active duty military members and other government employees can also contribute to a similar account called a Roth-TSP. The government rolled out this plan in 2012.

What is the Roth-TSP?

- It is a retirement/savings plan offered by the United States Government

- It is funded from money that comes out of your paycheck

- You can contribute up to $18k per year

- This money can be withdrawn tax-free when you retire

Who can contribute to a Roth-TSP?

- Active Duty Members of the Military (Army, Navy, Air Force, Marines, Coast Guard)

- Ready Reserve

- National Guard

How do I contribute to a Roth-TSP?

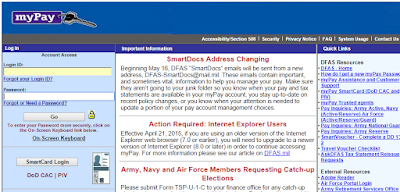

1.) Log in at mypay.dfas.mil

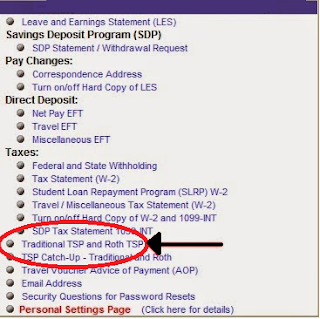

2.) Click on the “Traditional TSP and Roth TSP” link.

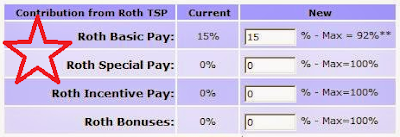

3.) Enter the percentage of your basic, special, incentive, and bonus pay that you want to contribute.

4.) Press submit and you’re done!

* If you prefer a paper form instead of doing this online, complete the TSP-U-1 form at www.tsp.gov

What type of funds can I put my money into?

There are 6 different funds that you can choose from. (C, F, G, I, L, & S)

- C – stocks (large and medium-sized companies) – S&P 500

- F – bonds (government)

- G – government securities

- I – stocks (international)

- L – stocks/bonds (retirement fund that changes its allocation as you get older)

- S – stocks (small and medium-sized companies)

If you are young like me I would recommend putting most if not all your money into stock funds. There is more risk with doing this but down the road, you will likely have gained a lot more money.

Why Do I think the Roth-TSP is Such a Good Idea?

I love that the money gets automatically deducted from my paycheck. This forces me to invest and be frugal with my money so that I can live a comfortable retirement

I love how low the expense ratios are. The expense ratio for all 6 funds is about 0.03%. This means you are paying $0.03 cents for every $100 they manage or $3 for every $10k they manage. This is the lowest expense ratio around. Vanguard which is known for its low expense ratios has its lowest fund at 0.05%. So the government is getting you a good deal in regards to the expense ratio.

You can contribute to both the Roth-IRA and the Roth-TSP. Between the Roth-IRA($5500) and the Roth-TSP($18000), you can contribute up to $23,500 a year into a tax-free retirement account! If you are married I would max out your wife’s Roth-IRA as well and make it $29,000.

What Other Military Financial Bloggers Think About the Roth-TSP

Spencer from the Military Money Manual

- “The Roth TSP meets all of the four criteria I look for in an investment: simple, low cost, diversified, and automatic. Some people complain about the lack of investment choices, but I believe that offering five low cost diversified funds keeps it easy to understand what you are investing in and hard to make mistakes. The expense ratios are the best in the world. You cannot invest anywhere else for cheaper. The diversification of the funds means you spread your risk around and don’t concentrate it in one or two stocks. Finally, the automatic withdrawal from myPay before you even see your paycheck make contributing to the TSP a no-brainer. If you are not investing in the TSP, you need to start today.” Link to article about TSP by Spencer

Rob from The Military Financial Planner

- “Two things I like about the TSP are that it is automatic, and it’s widely diversified. New service members are likely to get about 7 pay raises – for promotions, longevity, or inflation — in their first 4 years. The TSP savings rate they set from the start will increase their savings along with their base pay raises. The 5 basic TSP funds are broad-based index funds that cover nearly all of the US markets and a large portion of the international economy. The Lifecycle Funds, or ‘L’ Funds, are combinations of the 5 basic funds that are automatically allocated for the TSP participant. It doesn’t get much easier to save for retirement in quality, low-cost investments.” Link to article about TSP by Rob

Glenn and Andy from The Military Frequent Flyer

- “As an Army Reservist, I have found the TSP Program a great chance to build another 401K retirement fund. The rate of return on their funds tends to outperform many comparable funds and I don’t even notice the deductions as they are automatically taken out of my LES.”

- “In my opinion, you should be maximizing your Roth TSP and regular Roth before doing anything else financially. Nothing else will maximize your returns long-term as much as this”

My Investment Strategy for the TSP and Other Investments

My plan is to continue to max out ($5,500) my Roth-IRA. I use Vanguard and have my money in several of their ETF’s (VOO, VTI, VHT, VNQ)

Contribute 35% of my military income to the Roth-TSP (I choose 70% C, 20% S, 10% I)

I also plan to continue to try out other non-Roth investment opportunities that offer bonus sign-up offers or good rates. I would max out your Roth IRA and Roth TSP before doing other investments though. I am maxing out those so that’s why I am doing other things in addition. Here are some I am currently using.

- $5000 – Navy Federal CD (about once a year they offer a 5% CD rate for 1 year). Right now the rate is only 3.5%.

- $8000 – Robinhood. This is an app that lets you trade with no fees. I have money in Disney, Under Armour, Amazon, and U-Haul.

- $3000 – Ally Invest. They offer commission-free trades and an excellent user experience.

- $1000 – Motif Investing. They have a $150 bonus. In order to get the bonus, you have to make five trades. Each trade costs $9.95. So after trades, you basically get a $100 bonus. They also have another bonus of $100 after just making 1 trade which is a free $90.

If you have more questions about the Roth-TSP visit the official Roth-TSP website.

Max says

Awesome article and even better strategy. I didn't know about maxing out the Roth-TSP AND the regular Roth. Thanks for the tips!

Spencer says

I waited until the Roth TSP became available before I started investing in it. I missed 2 years of investing in the Traditional TSP and I'm kicking myself! The 2010-2012 market was a real bargain compared to today. Nice article, don't forget that you can contribute to your spouse's Roth IRA as well if your married filing jointly, even if they don't have income. That's $29,000 a year in tax advantaged retirement investments annually.