Starting Jan 2018, military members have an opportunity to switch over to the New Blended Retirement System.

The BIG question is…..Should I opt-in?

There’s a calculator that you can play around with. Personally, I find the calculator confusing though. To keep it simple, this is really what it comes down to.

• If you are 99% planning on staying active duty for at least 20 years, then stick with the current High Three retirement

• If you are not planning on staying in 20 years then take the new Blended Retirement System

I’m not planning on staying in 20 years so the answer is simple for me… take the new Blended Retirement System.

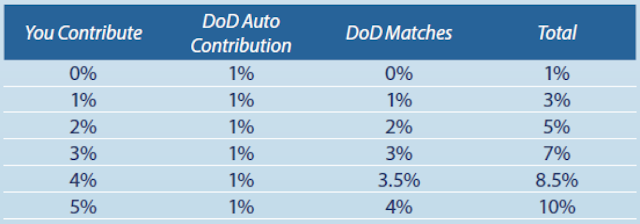

The BRS has a huge perk, they will match up to 5% of your base pay!

For example, let’s say on Jan 1, 2018 your monthly BASE PAY is $4000.

The DoD will automatically contribute 1% or $40/month into your TSP for FREE. (Thats $480/year)

If you contribute 5% of my base pay to the retirement system, the government will match that 5% (1% automatic + 4% match).

- With that 5% match, the government is giving you a FREE $2400/year!!!

- Obviously, this could be less or more depending on your rank/base pay.

Some important points (ROTH TSP vs TRADITIONAL TSP)

- The matching contributions will only be deposited in a traditional TSP. This means you can still put anywhere from $0-$18,000 into your Roth-TSP but all government matching contributions will be put into a separate Traditional-TSP.

- This is because, by law, matching contributions from employers are pre-tax — you must pay taxes on the earnings and deposits you make throughout your career.

- AGAIN, For Service Members that use a Roth TSP, they can still receive the matching contribution but it will automatically go into a separate traditional TSP account.

- The $18K annual contribution limit does not include employer matches. This means you can still max out your Roth TSP with $18K and get the free $1K – $6K (depending on your rank) deposited into your Traditional TSP.

Other Related Posts

- My Investment Strategy as an Active Duty Military Member

- How to Sign Up for the Thrift Savings Plan (TSP)